Our purpose and strategy

Our purpose is Helping Britain Prosper.

Scottish Widows was established in 1815, a time when there was no welfare state and the death of a family breadwinner could result in destitution.

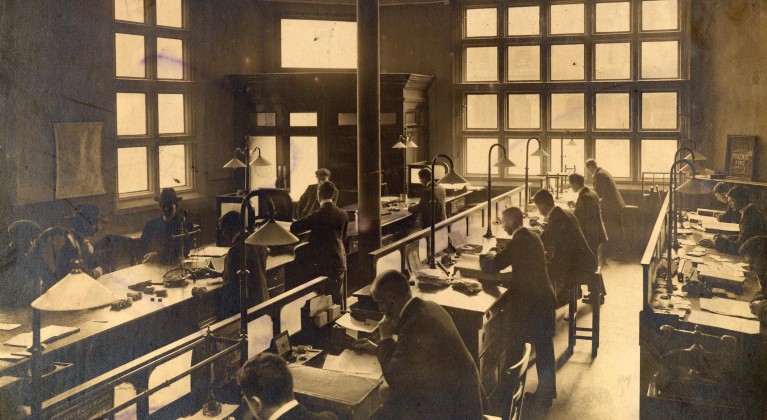

The early 19th century saw a steady rise in the formation of new life assurance companies. This was a time when there was no state provision for accidents or illness.

The Scottish Widows’ Fund and Life Assurance Society, as it was known, was originally set up to make provision for "widows, sisters and other females" in the event of the death of the policy holder.

Although business at Scottish Widows was initially slow, in the 1820s the firm established a raft of agencies across Scotland.

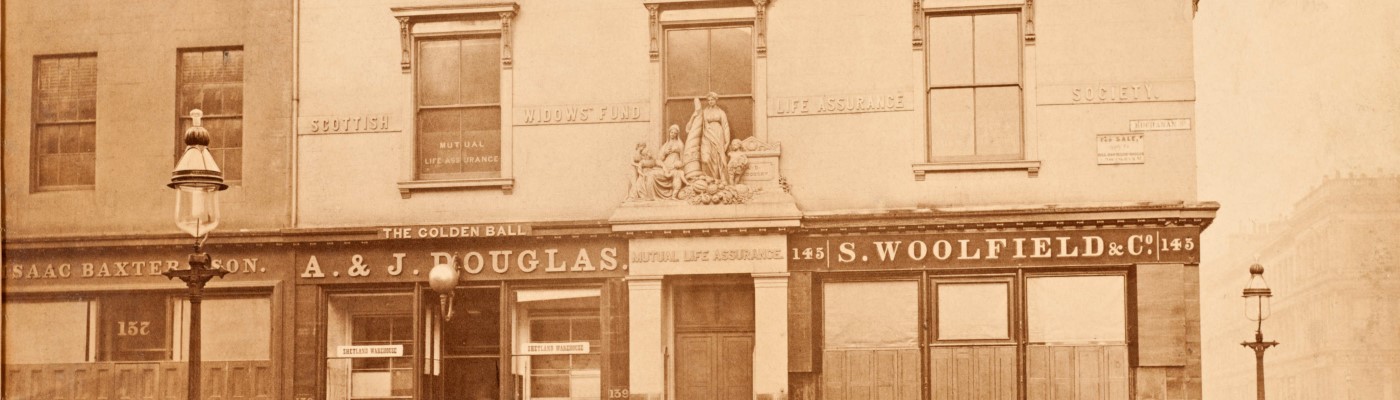

Then in 1832, it decided to move south, setting up agencies in England where there was an ‘extensive Scotch connection’. This included Manchester, London, Bradford and Liverpool. By 1862 it had become the largest mutual life office in the world.

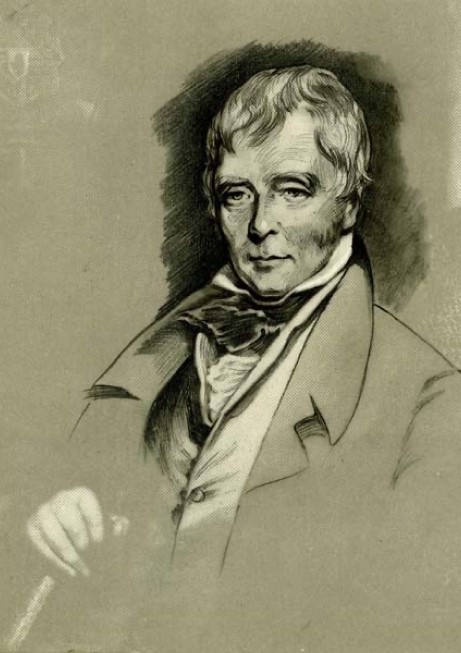

Sir Walter Scott, the famous Scottish author, applied for a policy in 1824. When he died eight years later his policy was worth £3,300, around £287,000 today.

John Clarke and Edwin Keeping had both taken out an insurance policy with Scottish Widows before they embarked on the fateful maiden voyage of the Titanic in 1912. Clarke was a member of the ship’s band, and Keeping had been a valet to one of the wealthier passengers.

Pioneering physician and surgeon, Louisa Garrett Anderson, took out a policy in 1914. She was also active in the women’s suffrage movement, treating suffragettes who had been force-fed in prison. Her partner, Dr Flora Murray was also a leading physician and suffragette, and appears on the back of Bank of Scotland’s £100 polymer note.

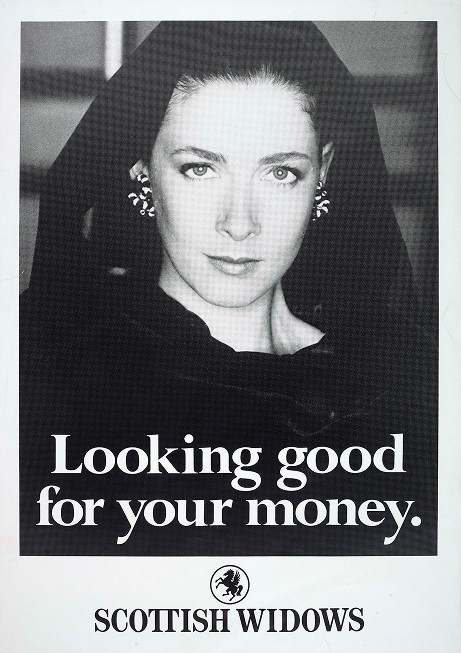

The strong confident ‘Widow’ has become an iconic advertising symbol, but she wasn’t the company’s first logo. An engraving of an earlier widow, kneeling with her children huddled behind her, was first used in 1818.

It was replaced in 1888 by Pegasus, the mythical winged horse representing immortality and the mastery of time. This symbol continued to be used until the 1980s, when the brand underwent a radical overhaul when the ‘living logo’ was born.

The first TV advert was directed by photographer David Bailey and starred Deborah Moore, daughter of Sir Roger, as the Widow. Recognition of the Scottish Widows brand rocketed from 34% to 92%.

There are echoes of Scottish Widows origins and original purpose (helping "widows, sisters and other females" in the event of a policy holder's death) in the work it does today.

Since 2005, it has published the ‘women and retirement’ report in order to draw attention to the gender pension gap and set out what needs to be done to address these challenges.

Bank of Scotland was founded in 1695, by an Act of the Scottish Parliament - making it Scotland's first and oldest bank.

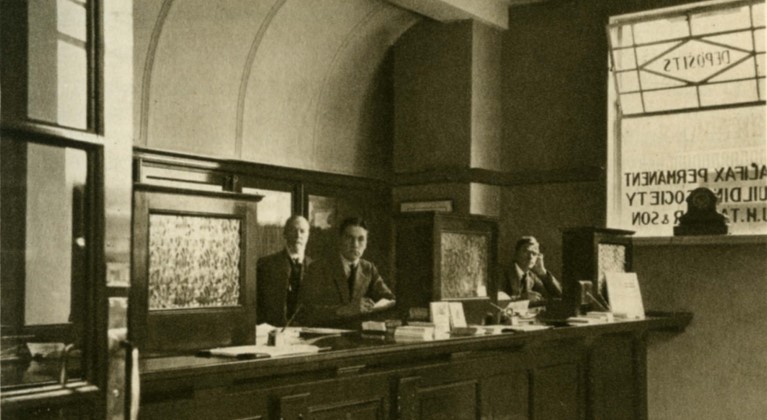

Founded in 1852, the Halifax is one of the UK's best known companies.

Lloyds Bank began as Taylors & Lloyds in Birmingham, in 1765.

Our museum is located in Edinburgh, in the Scottish Headquarters of Lloyds Banking Group. It charts the history of banking in Scotland, and explores the theme of money in all its shapes and forms.