Our purpose and strategy

Our purpose is Helping Britain Prosper.

Our purpose is Helping Britain Prosper.

We have an important role to play in creating a more sustainable and inclusive future.

Lloyds Banking Group incorporates many household names.

As with all necessary struggles it’s often the actions of brilliant and tenacious individuals that create lasting change.

Our report provides an update on how we are Helping Britain Prosper in a way that delivers long-term profit and returns.

We put you first, so you can put our customers first.

Our report provides an update on how we are Helping Britain Prosper in a way that delivers long-term profit and returns.

Secondary Navigation 'Sustainability policies and information' links to /content/gca/en-gb/home/sustainability/esg-policies-downloads

Disclosures relating to our strategic, financial, operational, environmental and social performance.

Latest and archived results for Lloyds Banking Group and its main subsidiaries.

See all the key dates in the financial year.

Higher, more sustainable returns as we continue to Help Britain Prosper.

Information and key documents for the wide range of securities issued by Lloyds Banking Group and its entities.

Over £1 billion of new finance can be available to businesses across the North East in 2026.

What’s next for the UK housing market in 2026? Outlook on interest and mortgage rates, first‑time buyers, rental reform and regional trends from Lloyds Banking Group.

Secondary Navigation 'Group news' links to /content/gca/en-gb/home/insights.f0-5.html#articleTop

With hubs across the UK, there's a place for you.

We're searching for the best talent to join us in Leeds.

Join us as we explore new ideas and technologies to reshape the world of finance.

Working with us gives you access to some of the UK’s household brands.

Secondary Navigation 'About applying' links to /content/gca/en-gb/home/careers/about-applying

Secondary Navigation 'Early careers' links to https://www.lloydsbankinggrouptalent.com/

Secondary Navigation 'Search jobs' links to /content/gca/en-gb/home/careers/job-search

Our purpose is Helping Britain Prosper.

We have an important role to play in creating a more sustainable and inclusive future.

Lloyds Banking Group incorporates many household names.

As with all necessary struggles it’s often the actions of brilliant and tenacious individuals that create lasting change.

Our report provides an update on how we are Helping Britain Prosper in a way that delivers long-term profit and returns.

We put you first, so you can put our customers first.

Our report provides an update on how we are Helping Britain Prosper in a way that delivers long-term profit and returns.

Disclosures relating to our strategic, financial, operational, environmental and social performance.

Latest and archived results for Lloyds Banking Group and its main subsidiaries.

See all the key dates in the financial year.

Higher, more sustainable returns as we continue to Help Britain Prosper.

Information and key documents for the wide range of securities issued by Lloyds Banking Group and its entities.

Over £1 billion of new finance can be available to businesses across the North East in 2026.

What’s next for the UK housing market in 2026? Outlook on interest and mortgage rates, first‑time buyers, rental reform and regional trends from Lloyds Banking Group.

With hubs across the UK, there's a place for you.

We're searching for the best talent to join us in Leeds.

Join us as we explore new ideas and technologies to reshape the world of finance.

Working with us gives you access to some of the UK’s household brands.

Use our timelines to explore more than 300 years of history.

The story of Lloyds Banking Group stretches back to 1695. Uncover this rich and unique heritage by taking a look at our timeline.

1695

Bank of Scotland was founded by an Act of the old Scots parliament on 17th July 1695 – making it Scotland's first and oldest bank. Start-up money was provided by the bank’s first shareholders – known as ‘adventurers’. The money raised was used to provide loans to support Scottish merchants and businesses.

1701

In 1701 Bank of Scotland was granted its very own coat of arms. The design featured a shield with a Saltire (white diagonal cross on blue background) around which were four gold circles representing money (coins). It is from these arms that the Bank’s modern logo is derived.

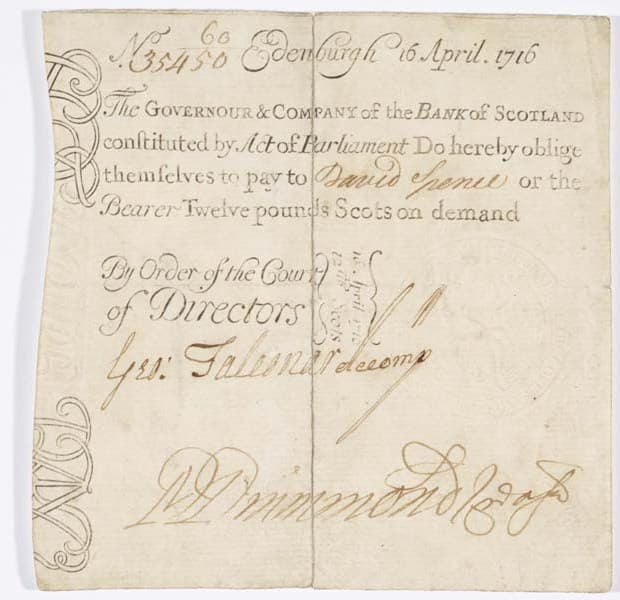

1696

Bank of Scotland issued its first banknotes in March 1696, worth £5, £10, £20, £50 and £100. They were the first examples of paper money with set values issued in Europe. Bank of Scotland still issues notes today, making it the longest continuous banknote issue in the world.

1765

Lloyds Bank began life as Taylors & Lloyds in 1765 as Birmingham’s first bank. It was founded by Sampson Lloyd, a Quaker and iron founder, and John Taylor, who had already set up Birmingham’s first factory. For the first 100 years, the bank prospered from a single office.

1815

Scottish Widows opened for business in Edinburgh in January 1815. The Scottish Widows’ Fund and Life Assurance Society, as it was first known, was originally set up to make provision for "widows, sisters and other females". But business was soon extended to provide life insurance cover for all.

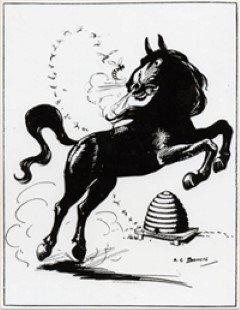

1822

Lloyds Bank’s first symbol was a beehive. It was introduced following a highway robbery in which £4,002 of Taylors & Lloyds’ banknotes were stolen. To make their notes more recognisable, the partners decided to include the beehive, chosen for its links to thrift and industry.

1852

The Halifax Permanent Benefit Building Society was founded in Halifax, West Yorkshire, in December 1852. It was a loan and investment society for working people. Those with spare cash could deposit it and receive interest. Others could then borrow funds to buy or build a house.

1853

The first Halifax mortgage was issued in May 1853 to local textile manufacturer Esau Hanson. Esau was loaned £121 to buy land to build a house – repaid over 13 years at 5 % interest.

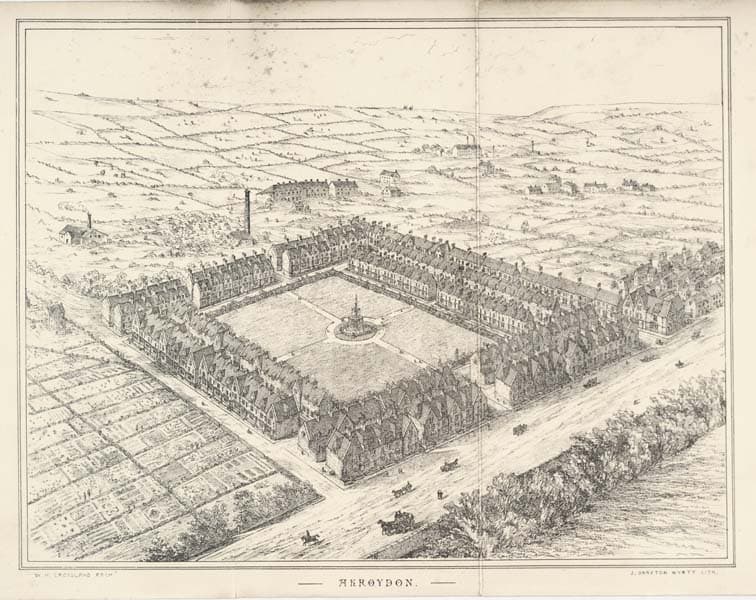

1860

The Halifax helped finance two housing schemes at Akroydon and West Hill Park in the 1860s. With people flocking to work in local textile mills, new homes were urgently needed. The new projects provided more than 200 houses for local people.

1865

After 100 years in business, Lloyds converted from a private partnership to a joint-stock bank. With 148 shareholders now investing in the company, its capital base was much stronger. A period of rapid expansion began, with Lloyds taking over more than 50 banks in the next 50 years

1884

Lloyds Bank inherited the famous black horse. It followed the take-over of City of London bankers Barnetts, Hoares & Co. The sign of the black horse had originally hung above the shop of Lombard Street goldsmith, Humphrey Stokes, from as early as 1677.

1888

Emma Wrigley was appointed agent (manager) of Halifax’s Longwood branch in 1888 – the first female branch manager we know of in the Group. Emma took over the position when her husband Walter died. When Emma retired in 1908 her daughter Mary took up the reins, until her death in 1938.

1912

Lloyds Bank completed the transfer of its head office from Birmingham to the City of London. In the 1920s existing buildings were razed to the ground and a stunning new art deco building was opened in Lombard Street in 1930. This served as its Head Office until 2003.

1914

With the outbreak of the First World War, Lloyds Bank employed women as clerks for the first time. They replaced men who had gone to fight. At the start of the war just six women were on the payroll. By the end, there were over 3,000, a third of the workforce.

1918

Lloyds Bank acquired Capital & Counties Bank, by far the largest of all its takeovers. This acquisition cemented Lloyds’ position as a national bank and one of the ‘big five’.

1918

More than 6,000 colleagues from across the Group went off to fight during the First World War, with some even joining the Bankers’ Battalion. Sadly, nearly 1,000 did not return. War memorials commemorating the fallen in both world wars can be seen in several of the Group’s key buildings.

1928

Banking methods had remained largely unchanged for centuries, with everything written out by hand. But in 1928, a machine was developed that revolutionised accounting. Balancing the books became faster and cheaper. By the end of 1929, Lloyds Bank’s City Office in London, and five other branches had been mechanised.

1930

The aftermath of the First World War brought a severe housing shortage. In the 1930s, the Halifax played a pivotal role in supporting national house building schemes, advancing money to developers at very low rates of interest. In total, it helped finance 14,000 new houses - 60% built under the government initiative.

1939-1945

As for the First, thousands of colleagues served in the Second World War. More than 600 gave their lives in this conflict including several female staff, and 18 were killed in air raids. Over 30 branches were damaged across the country. Fallen colleagues are commemorated on war memorials across the Group.

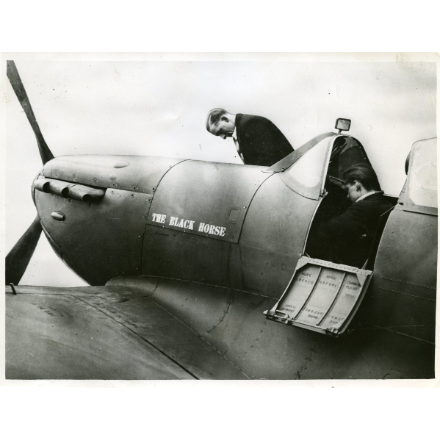

1941

During the Second World War, some 12,000 Lloyds Bank staff chipped in to purchase a Spitfire for the war effort. It was fittingly named 'The Black Horse'. Staff subscriptions rapidly reached more than £7,000, with donations averaging 12 shillings per person. The Spitfire went into action in March 1941

1948

At the London 1948 Olympic Games Lloyds Bank had a temporary branch on site, staffed by linguists. In addition, the Teddington branch manager was responsible for ensuring that the Olympic Flame remained alight during the torch relay. He followed the torch bearers in his Morris Minor with a hurricane lamp.

1949

Lloyds Bank abolished its marriage bar. Until then, all women had to resign when they got married. In 1924, one clerk had successfully concealed her marriage for a whole year. On finding out, the bank gave her six months’ notice. Bank of Scotland removed its marriage bar in the early 1950s.

1959

In 1959, Bank of Scotland became the first bank in the UK to install a computer. It was used at its new Central Accounting Unit in Edinburgh, to gather customer account data from branches. Lloyds Bank introduced its first computer in 1962.

1972

Lloyds Bank installed its first Cashpoint™ at Brentwood in Essex. It was the UK’s first online real-time cash machine, issuing variable amounts of cash and immediately debited the customer's account. By 1988, more than 2,000 were in operation up and down the country.

1980

In 1980 Halifax launched its ‘little Xtra’ advertising campaign - introducing the now familiar ‘X’ logo.

1985

Bank of Scotland launched its Home and Office Banking Service – the UK’s first home banking system. Customers could view their accounts and make payments from the comfort of their living room.

1988

Cashless shopping became a reality for Lloyds Bank customers with the introduction of its Visa payment card. Everyday purchases could now be made with plastic rather than coins and notes.

1988

Scottish Widows’ iconic ‘living logo’ was first seen on TV . Deborah Moore, daughter of Sir Roger, starred as the Widow. Recognition of the Scottish Widows brand rocketed from 34% to 92%.

1995

In December Lloyds Bank and TSB merged to form Lloyds TSB. However, the big change happened in 1999. Overnight, on 28th June, 2,380 branches were rebranded in a military-style operation. One branch make-over had to be delayed though, due to a nesting pigeon in its TSB signage.

1997

In 1997 the Halifax converted from a building society to a public limited company. The share flotation in June that year was the largest seen on the UK stock market, with some 7.5 million new shareholders created.

1998

Lloyds Bank launched an internet banking service, ‘Lloyds On-Line’. It was the first online service from a major UK bank accessed directly through a URL. 14,000 customers signed up for the initial launch. They could pay bills, transfer money between accounts, see statements, and change standing orders.

2000

Lloyds TSB took over Scottish Widows. Established in 1815, it was Scotland’s first mutual life office. It grew to become one of the largest suppliers of life assurance and investment products in the UK.

2001

Halifax and Bank of Scotland merged in 2001 to form HBOS plc - the fifth largest financial services company in the UK at the time.

2009

In the midst of a global financial crisis, Lloyds TSB took over HBOS plc to form Lloyds Banking Group. The new company instantly became the largest retail bank in the UK, bringing together a host of well-known brands.

2011

Mobile banking apps were introduced for Lloyds TSB, Halifax and Bank of Scotland customers. Everyday banking could now be done from a mobile phone.

2012

Lloyds TSB and Scottish Widows were the Official Banking and Insurance Partners of the London 2012 Olympic and Paralympic Games. The Games attracted more than 10,000 athletes from 204 nations. They took part in almost 300 events.

2014

The Group’s Helping Britain Prosper plan was launched, setting targets to help address social, economic and environmental challenges around the UK.

2017

Lloyds Bank took over UK consumer credit card business, MBNA.

2019

The Group and Schroders joined forces to create Schroders Personal Wealth. It was created to help more people across the UK benefit from financial advice.

2022

The Group acquired investment and retirement platform business, Embark.

2024

The famous Lloyds black horse logo underwent a major transformation. The horse was shown facing forwards for the first time, embracing the brand’s future-ready outlook. Starting with the high street brand, over the next year the horse was transformed across the Group.

Lloyds Banking Group was formed in 2009, but the origins of our core brands go back much, much further.

Since 1765, Lloyds Bank has been serving the people, businesses and communities of Britain.

Founded in 1852, the Halifax is one of the UK's best known companies.

Bank of Scotland was founded in 1695, by an Act of the Scottish Parliament - making it Scotland's first and oldest bank.

Scottish Widows' Fund and Life Assurance Society was established on 29th July 1814.