Our purpose and strategy

Our purpose is Helping Britain Prosper.

19 August 2021

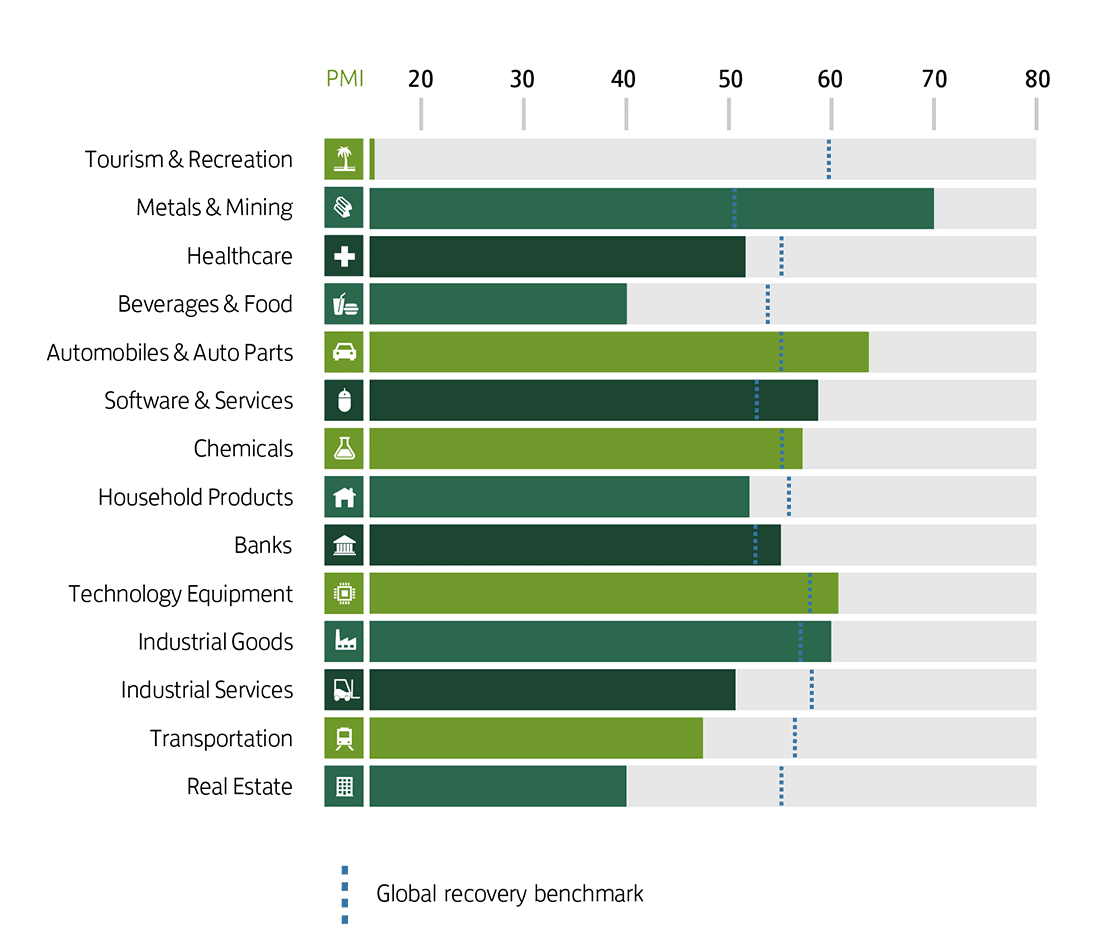

The number of UK sectors reporting output growth was not unanimous for the first time since March in July, as food and drink manufacturers wrestled with labour shortages and healthcare firms faced weaker demand, according to the Lloyds Bank UK Recovery Tracker.

Momentum in the UK food and drink sector stalled, as output declined at the fastest pace in eight months (45.6 in July vs. 60.5 in June). A reading above 50 signals output is rising, while a reading below 50 indicates contraction. Severe staff shortages, driven in part by large numbers of workers being asked to self-isolate, were cited as restricting production capacity.

Healthcare businesses’ output (48.7 vs. 50.1 in June) also recorded an overall fall in activity – the sector’s first drop in six months – as spending on pandemic-related healthcare continued to ease. This was seen in the sector’s new order index, which posted 48.0 on average in the three months to July.

Of the 12 sectors reporting growth, just four posted a faster month-on-month rate of expansion, down from five in June and 11 in May.

Technology equipment manufacturers (76.1 vs. 66.6 in June), which includes producers of specialist parts in smart devices, motor vehicles, computers and industrial machinery, posted the fastest overall rate of growth and the steepest month-on-month rise, boosted by strong domestic and overseas demand for critical components.

Technology demand also supported the UK software services sector (62.7 vs. 60.7 in June), which recorded its sharpest rate of expansion in nearly seven years.

Meanwhile, the tourism and recreation sector saw its growth rate ease, falling to 55.3 from 63.1 in June, a level which it’s the strongest output growth recorded since January 2012. Businesses pointed to a levelling-off in forward bookings for UK holidays, and cited restricted capacity caused by staff shortages – a key challenge also reported by firms in transportation (51.5 vs. 51.8 in June), particularly among hauliers.

Higher wage costs, driven by recruitment challenges, and increases in the prices of key inputs such as electronics, metals, steel and timber, contributed to a record pace of input price inflation in July.

Input costs rose for all 14 sectors monitored by the Tracker, with the composite input prices index registering 76.3 – the highest since the series began in January 1998.

Businesses in the services sector saw costs rise at an unprecedented rate since the services input prices index began in July 1996.

As a result, prices charged by businesses also increased at the fastest rate on record. All 14 sectors reported a price hike, with metals and mining, chemicals and household products posting the sharpest increase.

Ten of the 14 sectors monitored recorded a rise in the backlog of work, caused by ongoing pandemic-related supply issues and labour shortages. However, backlogs rose at a slower pace than in June, with only three sectors – transportation, banks and software services – seeing faster month-on-month growth in their volume of unfinished work.

UK sectors’ future output expectations dipped in July, to their weakest since January. Ten of the 14 sectors were less optimistic than they were in June about achieving stronger output volumes over the next 12 months.

Jeavon Lolay, Head of Economics and Market Insight, Lloyds Bank Commercial Banking, said: “Official data confirmed the rapid pace of UK economic growth in the second quarter as indicated by the Recovery Tracker in recent months. As the economy edges back towards pre-pandemic GDP levels, there will understandably be less capacity for such rapid and out-sized gains. The latest report for July supports this, with both fewer sectors posting faster month-on-month growth in output and a marked drop in optimism around future growth prospects.

“Another important area to closely monitor is the ongoing impact of surging input and output prices. It is clear that many businesses are facing growth constraints due to ongoing disruptions to supply chains and shortages of labour. These pipeline issues represent early indicators of the potentially broader inflationary pressures to come. While UK annual CPI inflation slowed in July, this will likely prove a temporary respite, particularly if businesses continue to face further price pressures.”

Scott Barton, Managing Director, Corporate and Institutional Coverage, Lloyds Bank Commercial Banking, said: “While the UK recovery remains on solid ground, staff shortages and higher materials costs are clearly disrupting current business activity and future prospects, most notably in the hospitality sector.

“Recent adjustments to the self-isolation rules should help alleviate staff shortages. However, the ongoing impact of the pandemic and Brexit may result in labour market pressures that persist for some time longer. Against this backdrop, management teams will be urgently considering how they can ensure their growth ambitions remain on track.”