Our purpose and strategy

Our purpose is Helping Britain Prosper.

18 August 2023

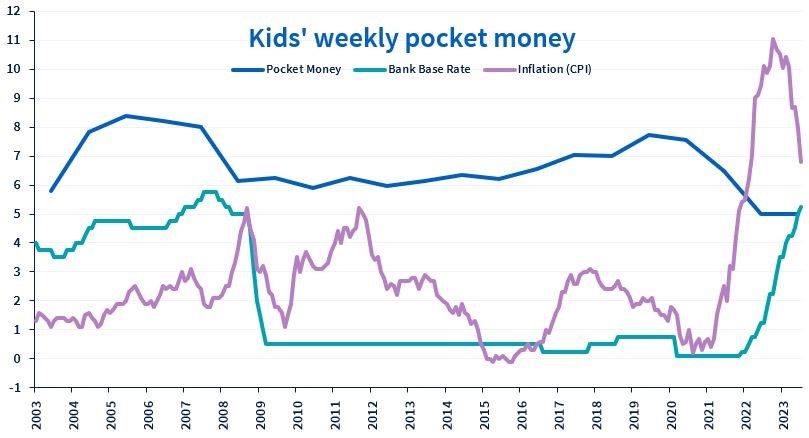

Children are pocketing £5 on average each week, according to the latest Halifax Pocket Money Review.

That’s no annual pay rise for the nation’s kids, with pocket money flat on 2022 (£4.99) and almost a fifth (19%) lower than a decade ago.

Despite increases over recent months to household bills, over half (55%) of parents haven’t made any changes to the amount of pocket money they regularly give their children.

Most children are receiving weekly cash from their parents (89%) although over a third (36%) get money from generous grandparents.

When set against the respective Bank Base Rate and inflation rate, it’s clear external factors impact the amount people give to children. Generally speaking, pocket money falls when people have less disposable income and, with interest rates returning to levels seen pre the 2008 financial crisis, and inflation still high, children are not seeing a rise in the money they pocket from their parents or other family members.

Andy Bickers, Savings Director, Halifax, said: “Pocket Money can be a great way for children to learn about saving, budgeting and spending responsibly. Talking openly with your children about money and giving them a set amount for helping around the home can encourage them to save up for whatever’s on their wish list and build healthy money habits.”

Children must earn their keep however, with just over half (51%) doing chores around the home to earn pocket money.

Unsurprisingly, certain chores are more popular than others and getting out the plunger and scrubbing brush is kids’ most hated chore.

Sweets are the most popular purchase with money earned from all that toilet scrubbing and room cleaning, with gaming and clothes in second and third place.

|

Cleaning the toilet |

32% |

|

Cleaning their room |

27% |

|

Doing the dishes |

12% |

|

Taking out the bins |

8% |

|

Gardening |

5% |

When it’s time to spend, most children prefer to make payments in cash (57%), with over a third opting for card (37%) and 6% using a digital wallet.

|

Sweets |

51% |

|

Gaming |

40% |

|

Clothes |

36% |

|

Toys |

32% |

|

Hobbies |

24% |

|

Make up |

21% |

|

Downloads |

14% |

|

Apps |

12% |

|

Donate to charity |

4% |

Selina Mitchard, mum of two (13 and 10 years old): “My son is using his financial skills to become an entrepreneur.”

“As busy working parents to our son Finlay and daughter Ava, we have always wanted them to learn how to save and spend responsibly.

“My eldest, Finlay, is turning into a budding entrepreneur. Alongside saving his pocket money he is now selling his old trainers, clothes and toys on marketplace websites and even has a spreadsheet tracking how much he has built up – saving hard towards his dream Playstation 5.

“Before the kids get their pocket money, they understand they must help with chores around our home such as unloading the dishwasher, hoovering and washing the car. They also know if they don’t do them - they don’t get paid!

“In our household, we keep an eye on our spending and look for ways to make savings where we can, but we haven’t really changed how much we give to the children each month.

“Finlay’s really happy that he has saved over £300 through his hard work, along with his regular pocket money, and is already two thirds of the way to buying his dream gaming station!”

Stash it: Give children a piggy bank, or set up an account, for them to save their own money and help them keep track of how it grows. Halifax Money Start, is a unique combined spending and saving account, designed to give 11 to 15 year olds freedom to independently manage their money, while providing parents with oversight of the account displaying it alongside parents’ own in their online banking.

Talk about it: Speak openly and regularly to kids about money, by discussing spending, budgeting and saving.

Set a goal: If there’s something a child really wants, such as a games console or their first car, sit down and discuss together how to make it a reality. Create a savings plan together, which covers how long and how much will need to be saved, to reach their goals. Help them picture something they really want and make a plan of how they can save for it.